The Hidden Dangers of Metaverse Real Estate—and How They Can Lead to Major Profits

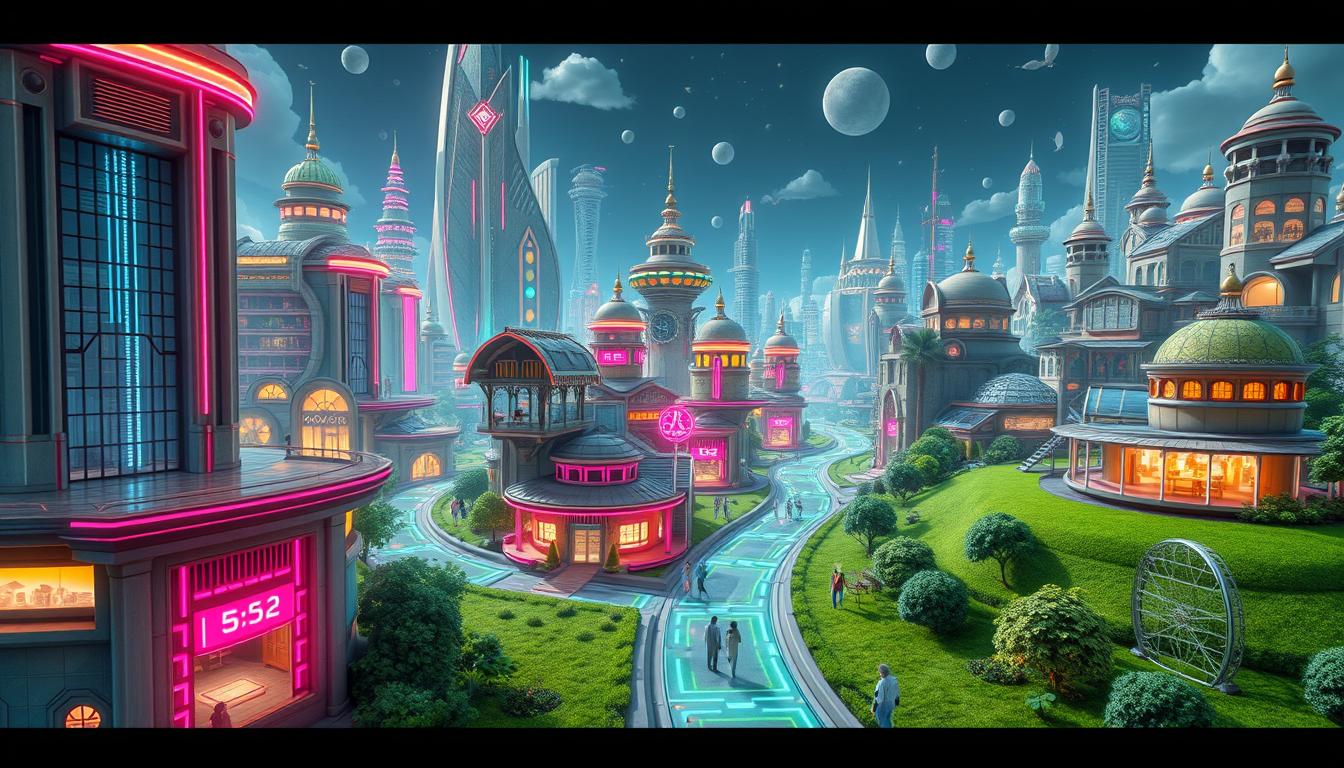

The Metaverse is changing how we live, work, and invest. In 2021, real estate companies got $12.2 billion in funding, a 34% jump from before. Now is the time to invest in virtual property, as some plots are selling for big profits quickly.

Big names like Facebook (now Meta), Microsoft, and Google are leading this digital shift. They’re spending billions to grow in the Metaverse. This new world offers chances for creators and businesses, from virtual stores to immersive offices. The growth potential is huge, and early investors could see big gains.

But, the Metaverse real estate market has risks. The recent drop in real estate company shares and a possible market correction are warnings. It’s important to invest fast and secure your virtual property before it’s too late.

Key Takeaways

- The Metaverse is transforming the way we live, work, and invest, with virtual real estate becoming a hot commodity.

- Early investors in Metaverse real estate are already seeing massive returns, with some properties flipping for significant profits in days.

- Major tech giants like Facebook (Meta), Microsoft, and Google are heavily investing in the Metaverse, creating endless opportunities for creators and businesses.

- As the market continues to grow, the risk of a bubble burst is also increasing, making it crucial to act quickly to secure your virtual property.

- Developing a strategic investment plan and understanding the Metaverse real estate landscape is key to maximizing your returns.

Understanding the Metaverse Real Estate Landscape

The metaverse real estate market has grown fast, with a 31.2% CAGR from 2022 to 2028. This growth shows the big potential of owning virtual property in digital worlds. But what is virtual property ownership, and which platforms are leading this market?

What Defines Virtual Property Ownership

In the metaverse, owning virtual property is like owning real estate. People can buy and own digital spaces, from land to buildings. These records are kept on blockchain, making them clear and verifiable.

Key Platforms for Digital Land Investment

- Decentraland: A leading metaverse platform, Decentraland lets users buy, develop, and earn from virtual land using MANA.

- The Sandbox: A well-known metaverse, The Sandbox lets users create, play, and earn from their digital experiences, including owning digital properties.

Current Market Valuation Trends

The metaverse real estate market has seen ups and downs. In 2022, digital land prices hit highs, with some selling for $450,000. But by 2024, prices dropped by 72% from their peak. Now, prices are down 55% since 2022 and 34% since, showing the market’s unstable nature.

Despite the ups and downs, the metaverse real estate market looks promising for the long term. As more people explore these digital worlds, prime locations are expected to become more valuable. This is due to factors like scarcity, market trends, and past sales.

Invest in Metaverse Real Estate 2024: Strategy Guide

The metaverse is set to be worth over $2.5 billion by 2030. This makes it a great place to invest. By investing in augmented reality real estate, futuristic digital assets, and web3 virtual land parcels, you can make a lot of money. To do well, you need to know how the metaverse works.

When you invest in metaverse real estate, it’s important to look at different platforms. Find areas that lots of people visit. Also, spread your money across different virtual worlds. Think about the platform’s user base, how it can grow, and if it uses cool tech like augmented reality.

- Look at top metaverse platforms: Places like The Sandbox and Decentraland are growing fast. They let you buy virtual land and create cool experiences.

- Find busy virtual spots: Just like in the real world, where you put your property matters. Choose places that lots of people go to and are likely to grow.

- Spread your investments: Don’t put all your money in one place. Putting it in different metaverse platforms can help you avoid big losses and find new opportunities.

| Metaverse Platform | User Base | Development Potential | Utility and Integration |

|---|---|---|---|

| The Sandbox | Over 2.5 million registered users | Robust ecosystem with extensive development tools and community support | Integrates with blockchain technology and supports NFTs, enabling users to create, own, and monetize virtual assets |

| Decentraland | Over 1 million registered users | Expanding virtual world with a focus on social interaction and user-generated content | Built on the Ethereum blockchain, allowing for decentralized governance and ownership of digital assets |

When you invest in the metaverse, timing is everything. Those who invest early can make a lot of money. Keep up with new tech and trends to find the best web3 virtual land parcels and futuristic digital assets for your portfolio.

Risk Assessment and Market Volatility Analysis

The metaverse property market is attracting a lot of investors. But, it’s important to look at the risks and how volatile it can be. This market reminds us of past tech booms, which could lead to a bubble and big price drops.

Market Correction Patterns

History shows that new tech areas often see prices rise too fast, then fall. The metaverse real estate market could see big price drops. This is especially true for properties that are overvalued or overhyped. Investors need to be ready for market downturns and have plans to exit.

Bubble Indicators and Warning Signs

It’s key to spot signs of a bubble in the metaverse property market. Look for unsustainable price growth, too much speculative buying, and platforms failing to meet promises. Paying attention to these signs can help investors make smart choices.

Portfolio Diversification Techniques

- Spread investments across multiple virtual worlds to mitigate concentration risk.

- Diversify your portfolio by investing in a mix of virtual land, non-fungible tokens (NFTs), and other digital assets.

- Invest in properties at different stages of development, from early-stage projects to more established virtual environments.

Using these diversification strategies can help manage risks in metaverse property speculation and digital asset volatility. This way, investors can protect their investments in virtual real estate.

| Metric | Value |

|---|---|

| Global Metaverse Revenue Opportunity (2024) | $800 billion |

| Metaverse Contribution to Global GDP (2031) | $3 trillion |

| Metaverse Active Users (2030) | 700 million |

| Metaverse Real Estate Market Value (2033) | $48.57 billion |

Maximizing ROI Through Strategic Development

Investing in metaverse real estate is more than just buying land. To get the most out of your investment, you need a smart plan for your digital properties. By creating fun experiences, hosting events, or building useful things, you can make your virtual property more valuable.

In the world of metaverse real estate monetization, the possibilities are endless. You can make money by renting out space, selling ads, or creating activities that bring in cash. Working with brands or influencers can also increase your digital land’s value. This is because digital land value increase depends on the experiences and offerings you provide.

To lead the way, you must be creative and flexible. The best virtual properties offer unique and engaging experiences. These experiences draw in users and make your investment stand out. By always looking for new ways to improve your virtual real estate, you can thrive in this fast-changing market.

As the metaverse grows, staying up-to-date and quick to adapt is crucial for making the most money. Knowing the latest trends, tech, and what users want helps you make smart choices. These choices can make your virtual properties stand out and keep bringing in money for years.

Conclusion: Future Outlook and Investment Timeline

The Metaverse real estate future looks bright. As tech improves and more people join, the market is set to grow. By 2033, it could hit $54.95 billion, growing at 38.20% each year.

This growth matches the expected 100 million Web3 users by 2024. It shows more people want to be in virtual worlds and own digital properties.

But, the market might see ups and downs, like the crypto and NFT markets. To succeed, investors need to be ready for a long wait. The Metaverse’s full potential might take years to see.

Future trends include better connections with the real world and more advanced virtual experiences. Also, new rules could change how the Metaverse works.

To make money, investors should keep learning and be patient. They can use AI, blockchain, and smart contracts to make deals safer and cheaper. With positive outlooks, now is a good time to look into Metaverse real estate.

FAQ

What is the Metaverse and why should I invest in its real estate?

The Metaverse is a digital world where people interact and own assets. It’s like a 3D internet where avatars and digital possessions are valuable. Early investors in Metaverse real estate are seeing big profits, with some properties flipping for huge gains in days.

What platforms are available for investing in Metaverse real estate?

Decentraland and The Sandbox are key platforms for digital land investment. They let users buy, develop, and make money from virtual properties. Blockchain technology secures ownership.

What are the current market valuation trends for Metaverse real estate?

The Metaverse real estate market is growing fast, with some properties selling for millions. Prime digital locations are expected to become even more valuable as more people join the Metaverse.

How can I strategize for investing in Metaverse real estate in 2024?

To invest in Metaverse real estate, understand its unique digital market. Research popular platforms, find high-traffic areas, and diversify investments. Keep up with tech advancements and user adoption.

What are the risks and volatility associated with Metaverse real estate investments?

The Metaverse real estate market can be volatile, like past tech booms. Prices may drop after rapid increases. Diversifying your portfolio can help manage these risks.

How can I maximize my ROI in Metaverse real estate investments?

Increase your property’s value by developing it strategically. Create engaging experiences, host events, or build useful structures. Monetize by renting, selling ads, or creating activities within your property.

What is the long-term outlook for Metaverse real estate investments?

The Metaverse real estate future looks bright, with growth expected as tech improves and more people join. But, expect volatility and potential corrections. Long-term investors should be ready for a multi-year journey.